Table of Contents

- TCJA Expiring: Taxes Are Set to Increase in 2026

- Tax Brackets Married Filing Jointly 2024 - Hedda Guglielma

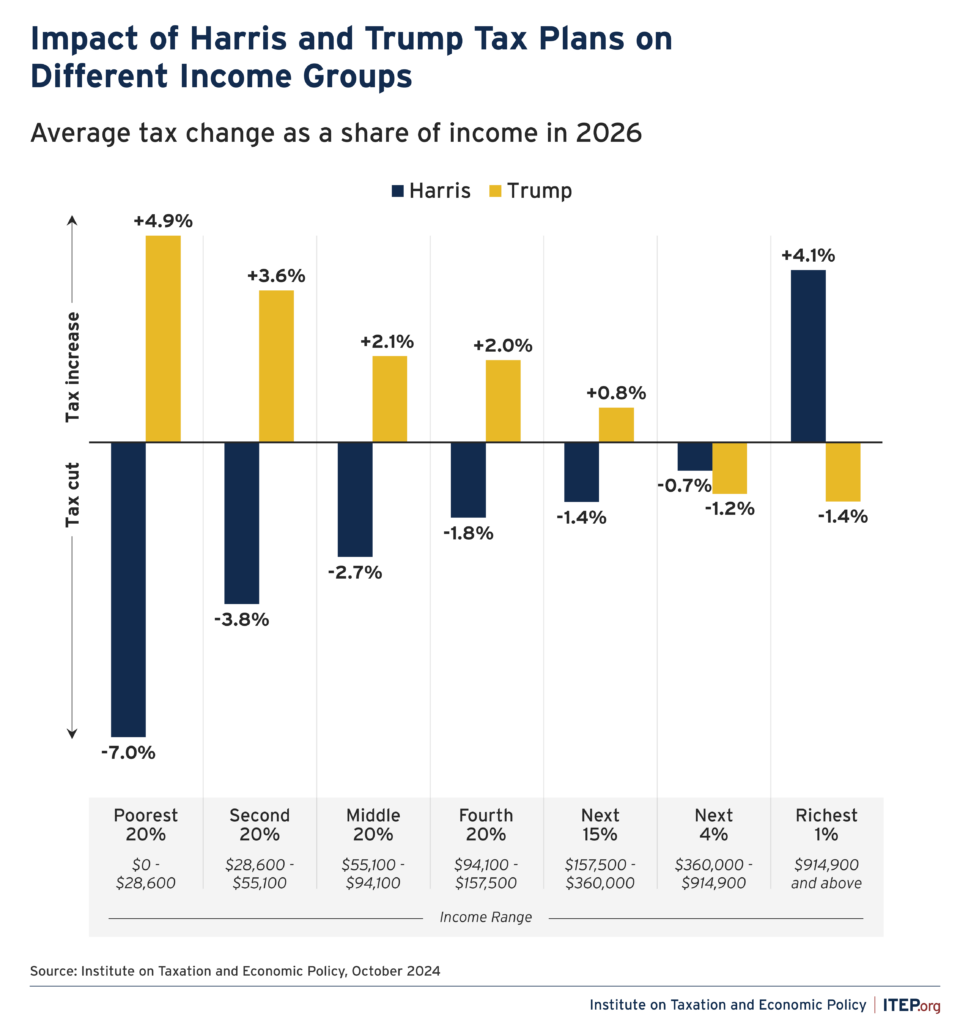

- How Would the Harris and Trump Tax Plans Affect Different Income Groups ...

- 2025 Vs 2026 Tax Brackets - List of Disney Project 2025

- 2024 Irs Tax Rate Schedule - Kira Serena

- 2026 Income Tax Increase - YouTube

- Tax Brackets For 2024 Head Of Household And Single - Teena Genvieve

- Plan now? The estate planning 2026 question mark | MassMutual

- Tax Brackets For 2024 Head Of Household And Single - Teena Genvieve

- Tax 2026 text on wooded blocks with blurred nature background. Taxation ...

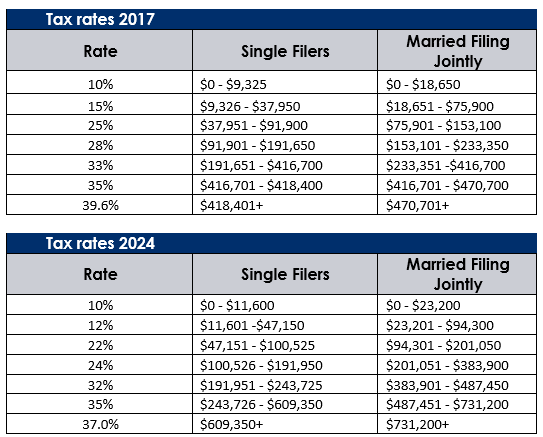

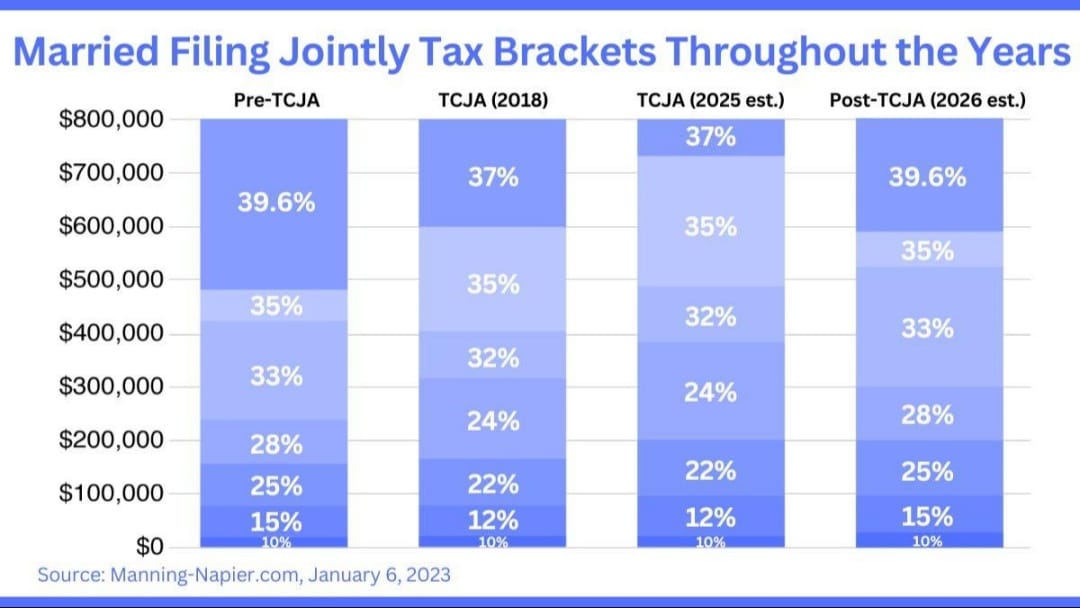

The TCJA, signed into law in 2017, introduced significant changes to the tax code, including the reduction of tax rates and the modification of tax brackets. The law's provisions are set to expire on December 31, 2025, unless Congress takes action to extend or make them permanent. If the TCJA expires, the tax brackets will revert to their pre-2018 levels, resulting in higher tax rates for many taxpayers.

Changes to Individual Tax Brackets

- 10%: $0 to $9,875 (single) and $0 to $19,750 (joint)

- 15%: $9,876 to $40,125 (single) and $19,751 to $80,250 (joint)

- 25%: $40,126 to $80,250 (single) and $80,251 to $171,050 (joint)

- 28%: $80,251 to $164,700 (single) and $171,051 to $326,600 (joint)

- 33%: $164,701 to $214,700 (single) and $326,601 to $414,700 (joint)

- 35%: $214,701 to $518,400 (single) and $414,701 to $622,050 (joint)

- 39.6%: $518,401 and above (single) and $622,051 and above (joint)

Impact on Businesses

The Tax Foundation's analysis suggests that the expiration of the TCJA would lead to a significant increase in tax revenues, but it would also result in a decrease in economic growth. The organization estimates that the expiration of the TCJA would lead to a 1.4% decrease in GDP and a 0.6% decrease in wages.

In conclusion, the expiration of the TCJA would have significant implications for taxpayers and businesses. The changes to the tax brackets in 2026 would result in higher tax rates for many individuals and businesses, leading to a decrease in economic growth. As the expiration date approaches, it is essential for taxpayers and financial planners to stay informed about the potential changes to the tax code and to plan accordingly. The Tax Foundation's analysis provides valuable insights into the potential effects of the TCJA's expiration, and it is crucial to consider these implications when making financial decisions.It is also important to note that the TCJA's expiration is not a certainty, and Congress may take action to extend or make the law's provisions permanent. As the situation develops, it is essential to stay up-to-date with the latest news and analysis from reputable sources, such as the Tax Foundation.

By understanding the potential changes to the 2026 tax brackets, taxpayers and businesses can better prepare for the future and make informed decisions about their financial planning. Whether you are an individual taxpayer or a business owner, it is crucial to stay informed and to seek professional advice to ensure that you are in compliance with the tax code and taking advantage of available tax savings opportunities.