Table of Contents

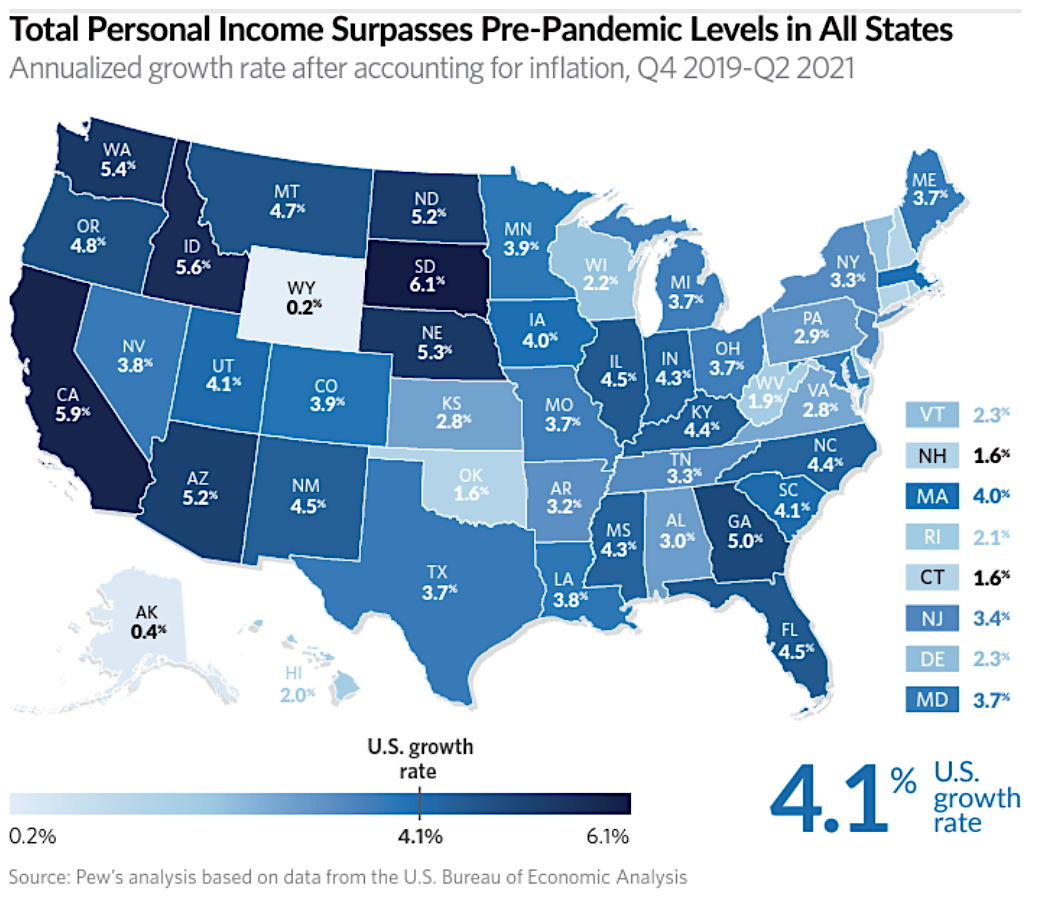

- California Only State Where Personal Income Rose Above Inflation Since ...

- PPIC Statewide Survey: Californians and Their Government - Public ...

- Wages Rise for Many, But Not for Californians Most Hit by Inflation

- Southern California Inflation Reaches Highest Level Since 1982

- Progress on the Inflation Front, and Can We Avert Stagflation ...

- What Is The Inflation Rate In California 2024 - Amity Merralee

- Inflation Threatens California’s Economic Recovery | San Jose Inside

- Making Sense of California’s Economy - Public Policy Institute of ...

- 2024 CA Inflation Forecast | Holman CA

- California Inflation Rate 2024 - Andy Amelina

What is Inflation?

Causes of Inflation

Effects of Inflation

Inflation can have both positive and negative effects on the economy. Some of the negative effects include: Reduced purchasing power: Inflation reduces the purchasing power of consumers, as the same amount of money can buy fewer goods and services. Uncertainty: Inflation creates uncertainty, making it difficult for businesses and individuals to plan for the future. Inequality: Inflation can lead to inequality, as those with fixed incomes or savings may see their purchasing power decline. On the other hand, some of the positive effects of inflation include: Stimulating economic growth: A moderate level of inflation can stimulate economic growth, as it encourages businesses to invest and consumers to spend. Reducing debt: Inflation can reduce the burden of debt, as the value of the debt decreases over time.

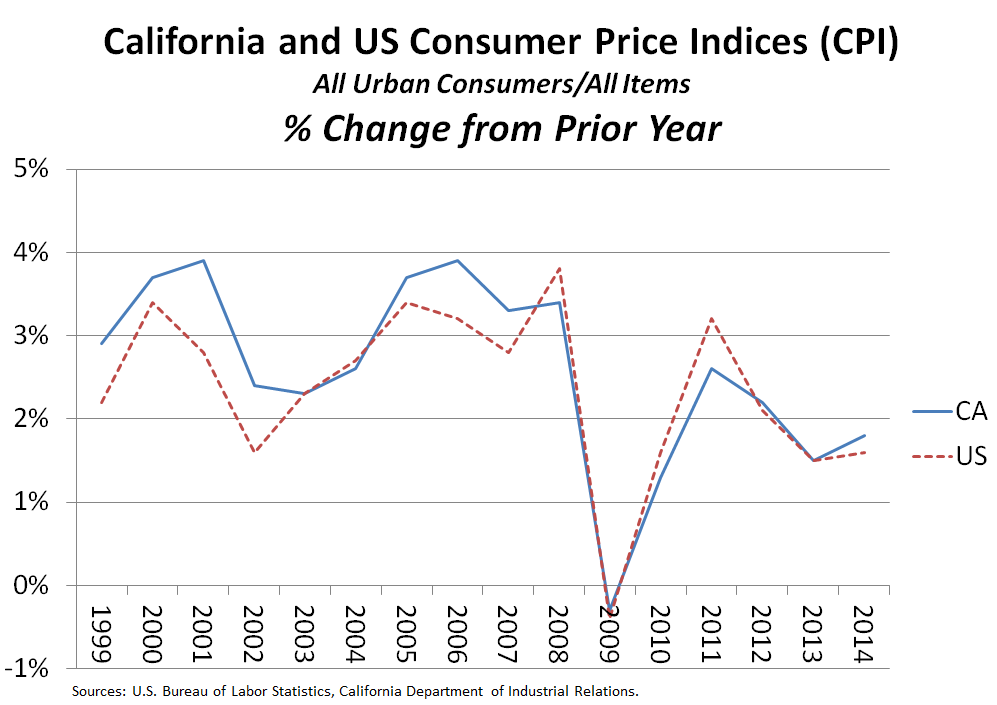

California Department of Finance and Inflation

The California Department of Finance plays a crucial role in monitoring and analyzing inflation trends in the state. The department uses various tools, including the CPI, to track inflation and provide forecasts and analysis to policymakers. The department also works with other state agencies, such as the Employment Development Department, to understand the impact of inflation on the labor market and the economy. Inflation is a complex economic phenomenon that affects the purchasing power of consumers, the profitability of businesses, and the overall health of the economy. The California Department of Finance plays a crucial role in monitoring and analyzing inflation trends in the state. By understanding the causes and effects of inflation, policymakers can develop effective strategies to mitigate its negative effects and promote economic growth. As the state's economy continues to evolve, it is essential to stay informed about inflation trends and their impact on the economy.For more information on inflation and the California Department of Finance, visit their website at https://dof.ca.gov/.