Table of Contents

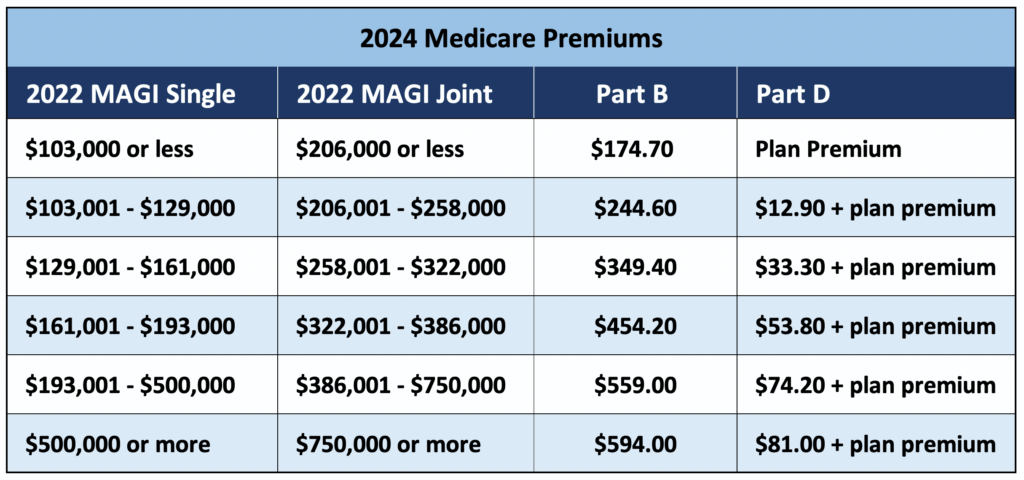

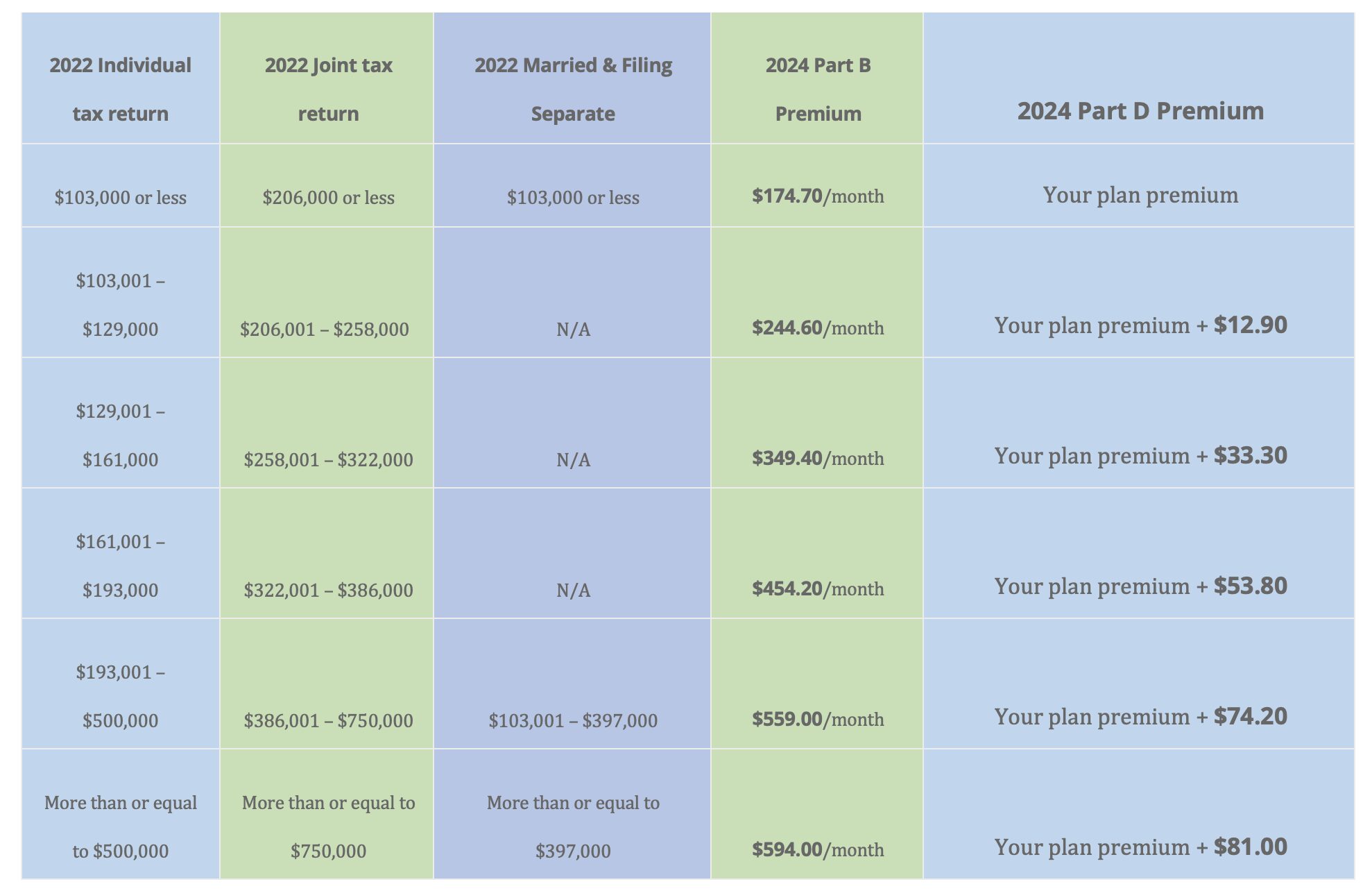

- IRMAA Rates Rising in 2024 with Medicare Premiums

- How to Avoid IRMAA: Medicare and Social Security Surcharges ...

- Medicare and Income Related Monthly Adjustment Amount - Ricky Credille ...

- 2024 Medicare IRMAA Explained - YouTube

- Do You Have Questions About Your Medicare Plan? | Brion Harris ...

- WHAT DOES IRMAA HAVE TO DO WITH YOUR MEDICARE PREMIUMS IN 2024? - Blair ...

- Irmaa 2024 Brackets And Premiums Chart - Cammie Nicole

- How Retirement Income Can Affect Your Medicare Costs - Medicare School

- The 2024 IRMAA Brackets – Social Security Intelligence

- WHAT DOES IRMAA HAVE TO DO WITH YOUR MEDICARE PREMIUMS IN 2024? - Blair ...

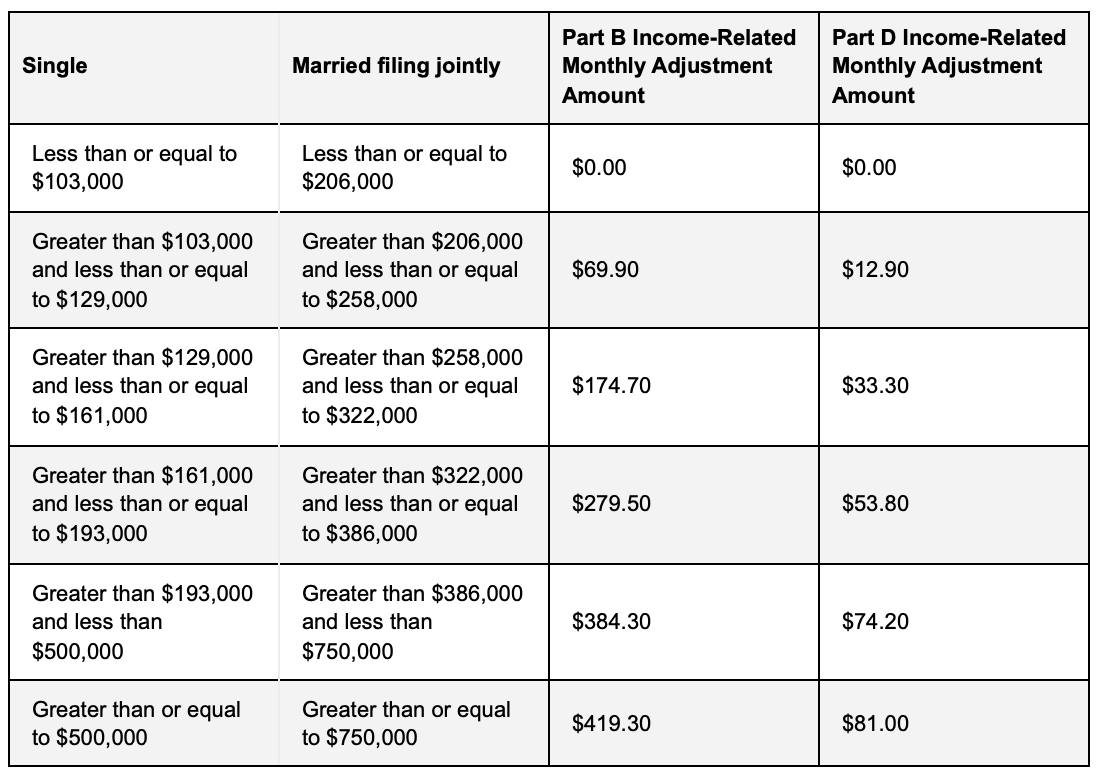

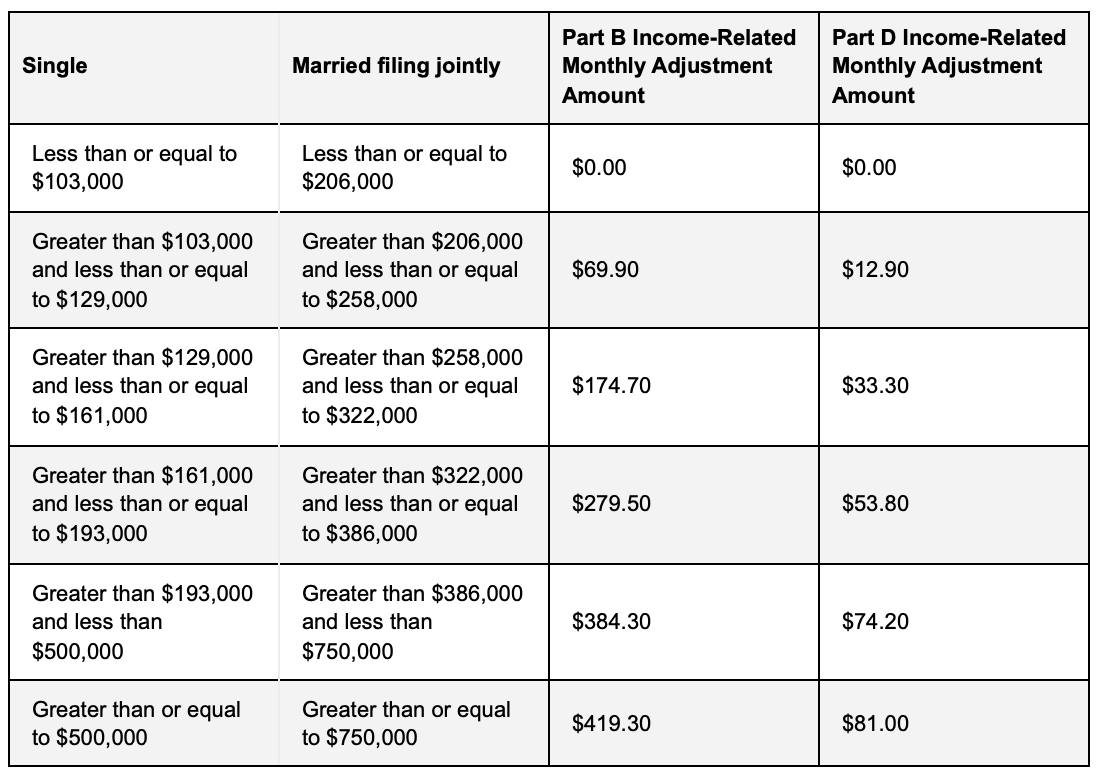

What is IRMAA?

How Does IRMAA Affect Your Medicare Costs?