Table of Contents

- OXY Stock Price and Chart — NYSE:OXY — TradingView

- OXY Stock Is Starting to Look Like an Exclusively Bearish Gamble ...

- Occidental Petroleum (OXY) Stock Analysis - Broke Investor

- OXY Stock Price and Chart — NYSE:OXY — TradingView

- 5 Top Stock Trades for Monday: JD, NVTA, SBUX, SPOT, OXY

- Occidental Petroleum (OXY) - stock value investment analysis (weekly ...

- More OXY purchased - Stocks A to Z - Motley Fool Community

- 7 Energy Stocks to Buy to Survive an Oil Beating CVX SLB EPD ...

- Occidental Petroleum (OXY) Stock Analysis: Should You Invest? - YouTube

- OXY for NYSE:OXY by Boring_Trader — TradingView

Company Overview

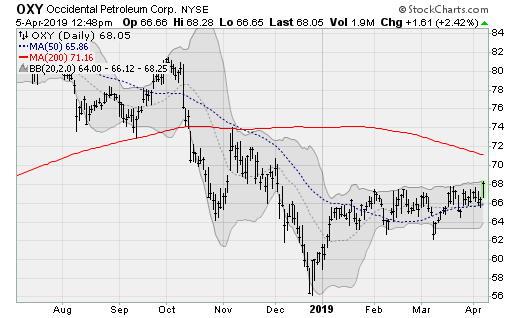

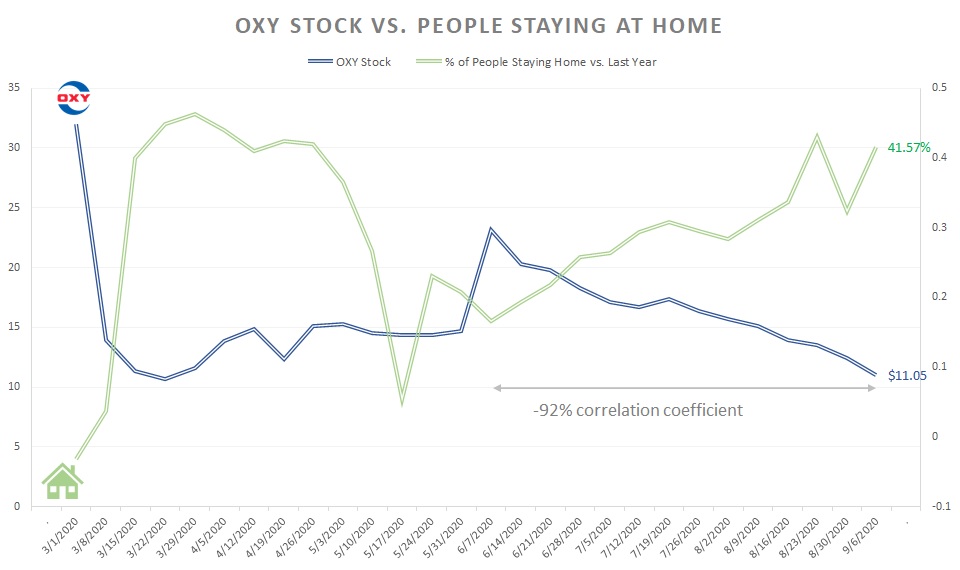

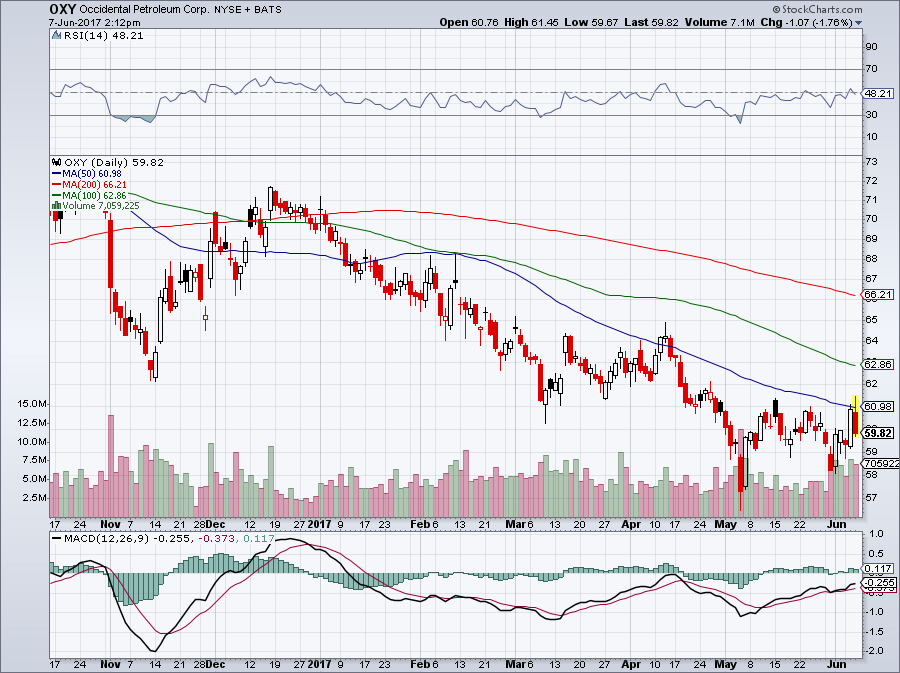

Stock Price and Performance

In terms of performance, OXY stock has underperformed the broader energy sector in recent months, with a year-to-date return of around -10%. However, the company's long-term prospects remain promising, driven by its diversified portfolio of assets, strong balance sheet, and commitment to sustainable growth. With a dividend yield of around 8%, OXY stock offers an attractive income stream for investors seeking regular returns.

Investment Outlook

So, is Occidental Petroleum stock a good investment opportunity? The answer depends on your individual investment goals and risk tolerance. While the energy sector is inherently volatile, OXY's strong track record, diversified operations, and commitment to sustainability make it an attractive option for investors seeking exposure to the industry.Some key factors to consider when evaluating OXY stock include:

- Dividend yield: OXY's high dividend yield provides a regular income stream, making it an attractive option for income-seeking investors.

- Operational efficiency: The company's focus on cost reduction and operational excellence positions it well for long-term success.

- Sustainability: OXY's commitment to reducing its environmental footprint and promoting sustainable practices aligns with the growing demand for responsible investing.

- Geopolitical risks: As a global energy company, OXY is exposed to geopolitical risks, which can impact its operations and stock price.